Startups are thriving in India.

The government is actively supporting young entrepreneurs in launching their startups.

These startups contribute significantly to the growth of the country’s economy.

A startup is defined as a business that delivers innovative products or services aimed at solving societal issues.

Additionally, a startup can enhance an existing product or service, transforming it into an improved version.

Steps to Register Your Startup With Startup India

Step 1: Incorporate your Business

To begin, you need to register your business as either a Private Limited Company, a Partnership firm, or a Limited Liability Partnership. It is essential to adhere to the standard procedures for business registration, which include submitting the registration application and acquiring the Certificate of Incorporation or Partnership registration.

You can set up a Private Limited Company or a Limited Liability Partnership (LLP) by submitting the registration application to the Registrar of Companies (ROC) in your area. For establishing a Partnership Firm, you must file the registration application with the Registrar of Firms in your locality. Ensure that you provide the necessary documents and fees to the Registrar of Companies or Registrar of Firms along with your registration application.

Step 2: Register with Startup India

Subsequently, the company needs to be registered as a startup. The whole procedure is straightforward and can be completed online. Go to the Startup India website and select the ‘Register’ button as illustrated below.

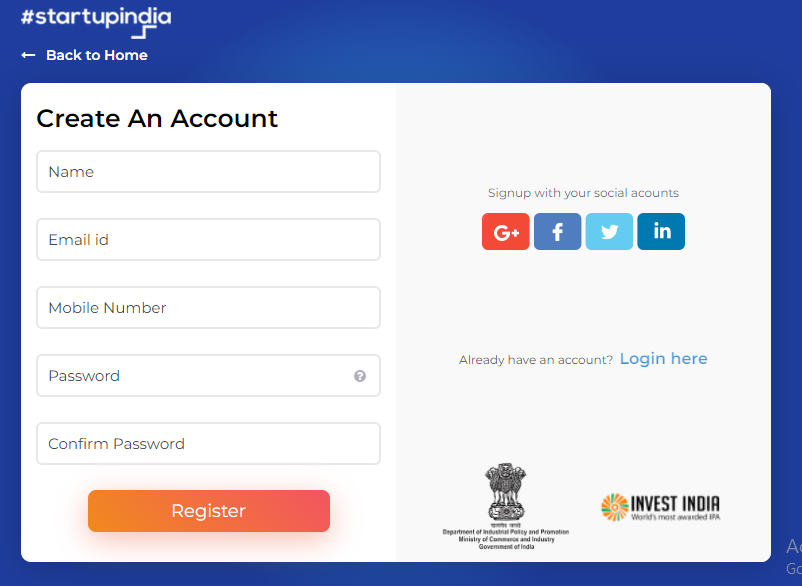

Please provide your name, email address, mobile number, and password, then click the ‘Register’ button.

Next, input the OTP that has been sent to your email, along with other information such as the type of user, your name, and the stage of your startup, etc., and then click the ‘Submit’ button. After you have provided these details, your Startup India profile will be established.

Once your profile is set up on the website, startups will be able to apply for a range of acceleration and incubator/mentorship programs available on the site, as well as gain access to educational resources, funding opportunities, government initiatives, and market access.

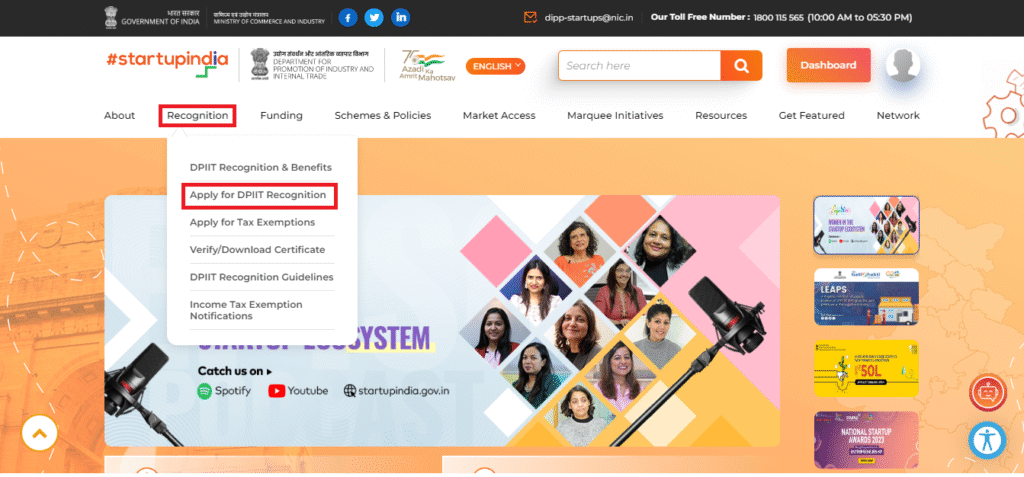

Step 3: Get DPIIT Recognition

The subsequent step following the creation of your profile on the Startup India Website is to obtain the Department for Promotion of Industry and Internal Trade (DPIIT) Recognition. This recognition enables startups to access various benefits, including high-quality intellectual property services and resources, leniency in public procurement regulations, self-certification for labor and environmental laws, simplified company winding procedures, access to the Fund of Funds, tax exemptions for three consecutive years, and tax exemptions on investments exceeding fair market value.

To acquire DPIIT Recognition, log in using your registered account credentials on the Startup India website and select the ‘Apply for DPIIT Recognition’ option found under the ‘Recognition’ tab.

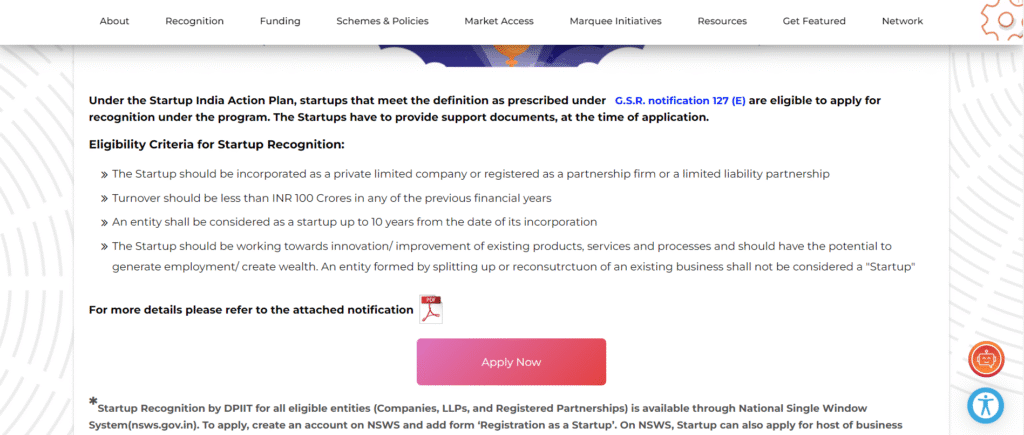

On the next page, click on ‘Apply Now’. It will redirect to the National Single Window System (NSWS) website. Companies and LLPs should register on the NSWS website, add form ‘Registration as a Startup’ and fill ‘Startup Recognition Form’ to get DPIIT recognition.

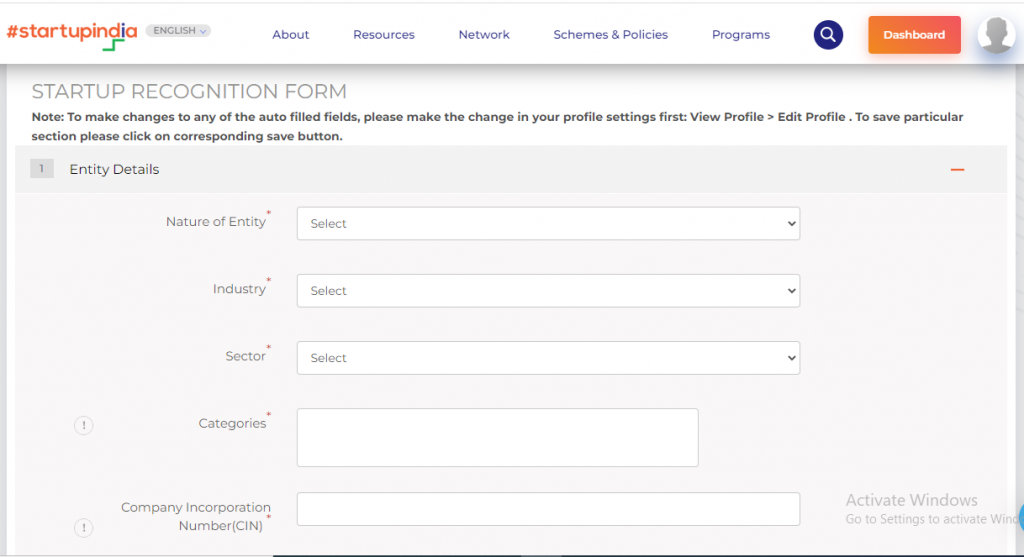

Step 4: Recognition Application

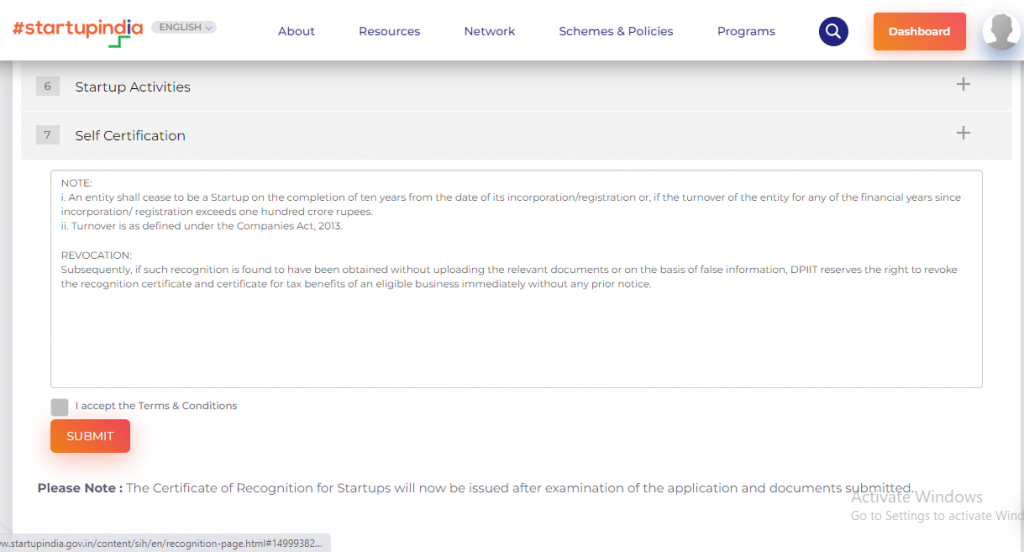

On the ‘Startup Recognition Form’, you are required to provide information including the entity details, complete office address, authorized representative information, details of directors or partners, necessary information, startup activities, and self-certification. To fill out each section of the form, click the plus sign located on the right-hand side of the form.

After entering all the sections of the ‘Startup Recognition Form’, accept the terms and conditions and click on the ‘Submit’ button.

Step 5: Documents for Registration

- Incorporation/Registration Certificate of your startup

- Proof of funding, if any

- Authorisation letter of the authorised representative of the company, LLP or partnership firm

- Proof of concept like pitch deck/website link/video (in case of a validation/ early traction/scaling stage startup)

- Patent and trademark details, if any

- List of awards or certificates of recognition, if any

- PAN Number

Step 6: Recognition Number

That’s all! Upon application, you will receive a recognition number for your startup. The certificate of recognition will be granted following the review of all your documents, which typically occurs within 2 days after you submit the information online.

Step 7: Other Areas

Patents, trademarks and/or design registration:If you require a patent for your invention or a trademark for your company, you can conveniently contact any of the facilitators provided by the government. You will only need to pay the statutory fees, resulting in an 80% reduction in costs.

Funding: One of the primary obstacles encountered by numerous startups is securing financing. Entrepreneurs often struggle to draw in investors due to their lack of experience, collateral, or established cash flows. Additionally, the inherently high-risk profile of startups, with a considerable proportion failing to launch successfully, deters many potential investors.

To address this funding gap, the Government introduced the Startup India Seed Fund Scheme (SISFS) on January 21, 2021, with a budget of Rs.945 crore aimed at offering financial support to startups over the next four years.

Self Certification Under Employment and Labour Laws: Startups have the option to self-certify in accordance with labor and environmental regulations, which helps lower their compliance expenses. This self-certification is designed to alleviate regulatory pressures, enabling startups to concentrate on their primary business activities. They are permitted to self-certify their compliance with 6 labor laws and 3 environmental laws for a duration of 3 to 5 years from their incorporation date.

Businesses functioning within 36 white category industries, as listed on the Central Pollution Control Board’s website, are exempt from obtaining clearance under 3 environmental Acts for a period of 3 years.

Tax Exemption: Startups are granted a 3-year exemption from income tax. However, to benefit from this, they need to be certified by the Inter-Ministerial Board (IMB). Startups that were established on or after April 1, 2016, are eligible to apply for the income tax exemption.

Demos

Demos  Colors

Colors  Docs

Docs  Support

Support