The Budget 2025 has updated the classification for MSMEs. This updated classification will take effect on 1 April 2025. Below are the previous and revised limits:

| Criteria | Micro | Small | Medium |

|---|---|---|---|

| Previous Investment & Annual Turnover | Up to Rs. 1 crore | Up to Rs. 10 crore | Up to Rs. 50 crore |

| Revised Investment & Annual Turnover | Up to Rs. 2.5 crore | Up to Rs. 25 crore | Up to Rs. 125 crore |

| Previous Turnover Limit | Up to Rs. 5 crore | Up to Rs. 50 crore | Up to Rs. 250 crore |

| Revised Turnover Limit | Up to Rs. 10 crore | Up to Rs.100 crore | Up to Rs. 500 crore |

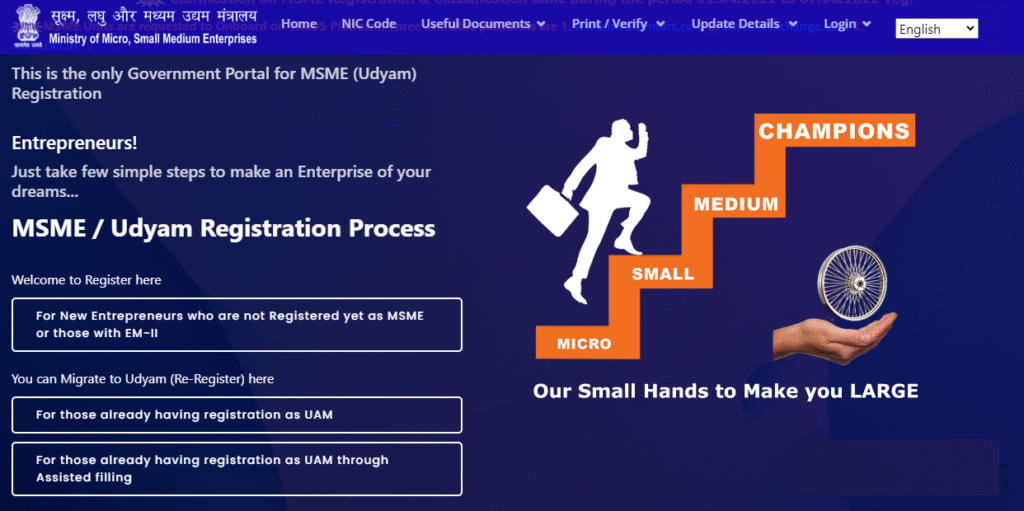

What is MSME Udyam Registration?

MSME registration, also known as Udyam registration, is available for entities that meet the MSME classification criteria. These entities can apply for MSME registration through the government’s Udyam portal. The registration process is fully online and can be completed via the Udyam registration portal. While it is not compulsory for MSMEs to obtain this registration, doing so is advantageous as it offers numerous benefits related to taxation, business establishment, credit facilities, loans, and more.

Currently, there are over 1 crore registered MSMEs that employ approximately 7.5 crore individuals. These MSMEs contribute 36% to India’s manufacturing sector and 45% to its exports, thereby positioning the country as a global manufacturing hub known for its high-quality products.

MSME Registration Eligibility

All manufacturing and service sectors, along with wholesale and retail trade that meet the updated MSME classification requirements regarding annual turnover and investment, are eligible to apply for MSME registration.

Therefore, the eligibility for MSME registration is determined by an entity’s annual turnover and investment. The entities listed below qualify for MSME registration:

- Individuals, startups, business owners, and entrepreneurs

- Private and public limited companies

- Sole proprietorship

- Partnership firm

- Limited Liability Partnerships (LLPs)

- Self Help Groups (SHGs)

- Co-operative societies

- Trusts

Documents Required for MSME Registration

The MSME registration documents are as follows:

- Aadhaar card

- PAN card

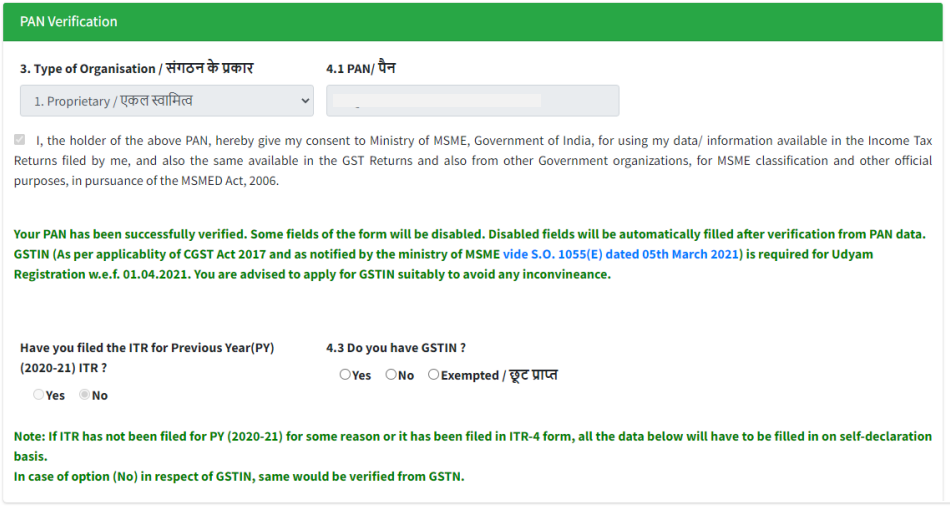

There are no MSME registration fees. The process does not necessitate the submission of documents. The Udyam Registration Portal will automatically retrieve PAN and GST-linked information regarding the investment and turnover of businesses from government databases, as it is connected to the Income Tax and GSTIN systems.

GST registration is not compulsory for enterprises that do not require a GST Registration.

However, businesses that are required to obtain GST registration according to the GST law must provide their GSTIN in order to secure MSME Registration or Udyam Registration.

How can one apply for MSME registration on the Udyam Registration Portal?

The MSME registration process is entirely online. MSME online registration is to be done on the government portal of udyamregistration.gov.in. There is no MSME registration fee charged for registration. MSME registration online can be done under the following two categories in the portal –

- For New Entrepreneurs who are not Registered yet as MSME or those with EM-II and

- For those having registration as UAM and For those already having registration as UAM through Assisted filing

For New Entrepreneurs who are not Registered yet as MSME or those with EM-II

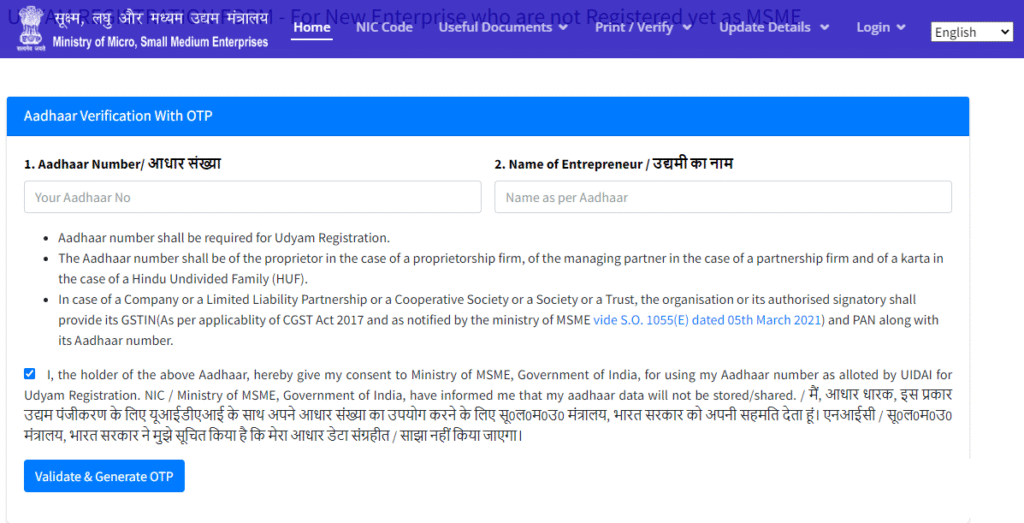

Step 1: New entrepreneurs and those with EM-II registration must click the button labeled “For New Entrepreneurs who are not Registered yet as MSME or those with EM-II” found on the home page of the Udyam Registration Portal.

Step 2: On the following page, input the Aadhaar number along with the entrepreneur’s name, then click on the “Validate and Generate OTP Button.” After clicking this button and receiving the OTP, enter it to access the PAN Verification page.

Step 3: The entrepreneur is required to input the “Type of Organisation” and the PAN Number, then click the “Validate PAN” button. The portal retrieves the PAN details from government databases to verify the entrepreneur’s PAN number.

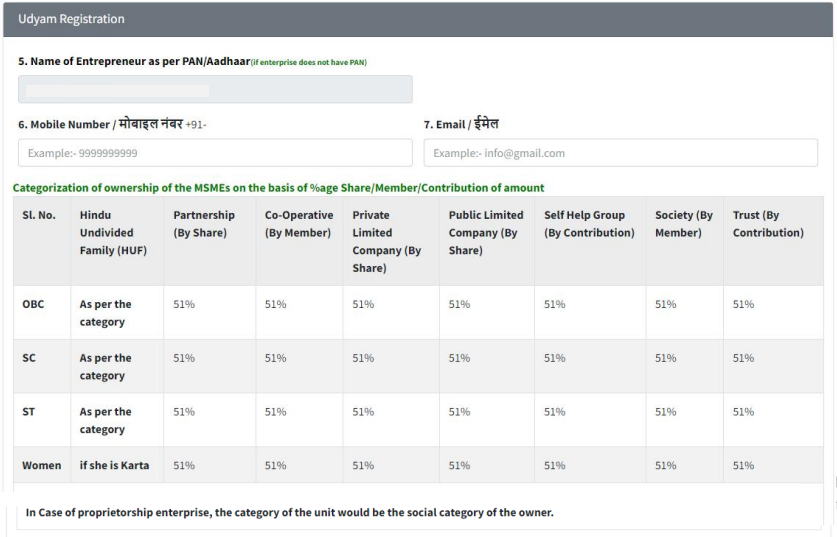

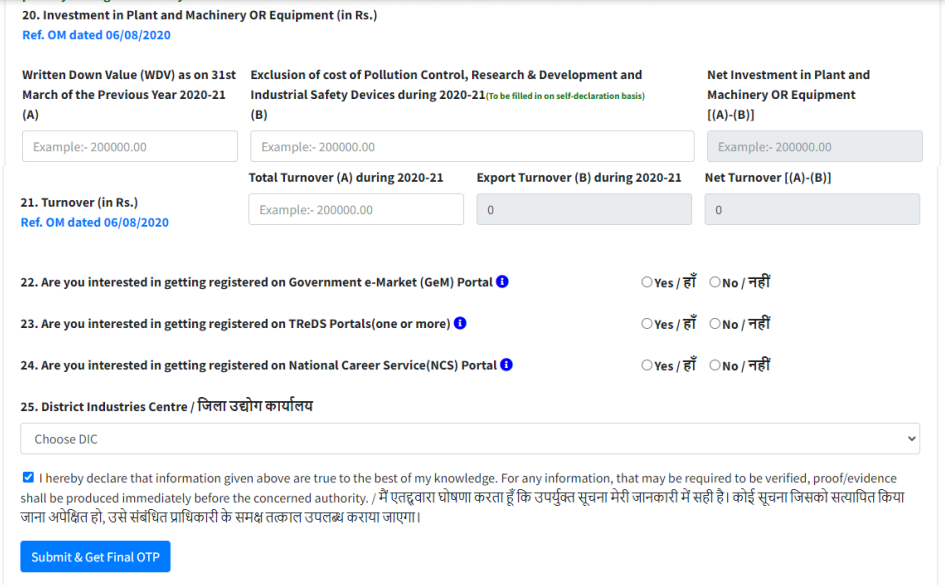

Step 4: Upon confirming the PAN, the Udyam Registration form will be displayed, requiring entrepreneurs to complete their personal information along with the details of their business.

Step 5: Input the investment and turnover information, choose the declaration, and press the “Submit and Get Final OTP” button. The OTP will be dispatched, and once you enter the OTP and submit the form, the Udyam Registration Certificate will be emailed to you. Additionally, entrepreneurs can check the MSME registration status via the Udyam Registration Portal.

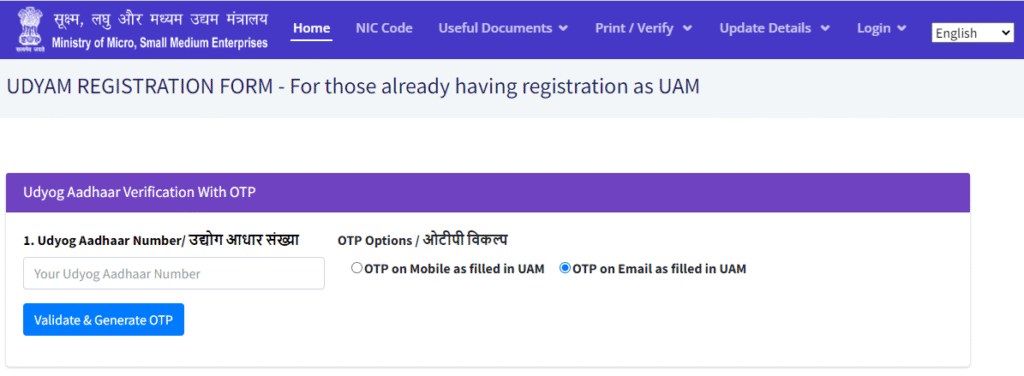

Registration For Entrepreneurs Already Having UAM

For individuals who already possess UAM registration, it is necessary to click on the button labeled “For those having registration as UAM” or “For those already having registration as UAM through Assisted filing” located on the home page of the government portal. This action will lead to a page where the Udyog Aadhaar Number must be entered, and an option for OTP should be selected.

The available options include receiving the OTP on the mobile number provided in the UAM or receiving it via email as specified in the UAM. Once the OTP option is selected, the next step is to click on “Validate and Generate OTP.” After entering the OTP, the registration details should be completed on the MSME registration form, thereby finalizing the Udyam registration.

MSME Registration Fees

There are no fees charged by the government for MSME registration. It is free of cost on the official website, i.e. Udyam Portal.

MSME Registration Certificate

The Ministry of MSME issues an e-certificate known as the Udyam Registration Certificate to MSMEs in India. The Udyam registration certificate is known as the MSME registration certificate. The entrepreneurs receive the MSME registration certificate upon completion of the MSME registration process. The certificate will contain a QR Code, from which the enterprise details can be accessed.

MSME Registration Number

An enterprise having an MSME registration is known as Udyam, and the permanent identity number assigned to by the Ministry of MSME is known as the ‘Udyam/MSME Registration number’. The MSME Registration Certificate will contain the 19-digit MSME/Udyam Registration Number.

MSME Registration Status

Below is the process to check MSME Registration Status:

- Visit the Udyam registration portal.

- Click on the ‘Print/Verify’ option and click on the ‘Verify Udyam Registration Number’ option.

- Enter the ‘Reference Number’, enter the captcha code and click on the ‘Verify’ button.

MSME Registration Certificate Download

Below is the process to download the MSME Registration Certificate:

- Visit the Udyam registration portal.

- Click the ‘Print/Verify’ option and select the ‘Print Udyam Certificate’ option.

- Enter the ‘Udyam Registration Number’, ‘Mobile’, choose the OTP option and click on the ‘Validate & Generate OTP’ button.

- Enter the OTP received on the mobile/email and click on the ‘Validate OTP and Login’ button.

- After logging in, take a printout of the Udyam registration certificate.

How to check MSME registration by name?

You cannot check the MSME registration number by name. However, you can retrieve your MSME registration number by following the below process:

- Visit the Udyam Registration Portal.

- Click on the ‘Forgot Udyam/UAM No.’ option under ‘Print/Verify’ option on the homepage.

- Choose the registration option.

- Choose the OTP option.

- Enter the mobile/email address.

- Click on the ‘Validate & Generate OTP’ button.

- Enter the OTP. The MSME registration number will be displayed.

Demos

Demos  Colors

Colors  Docs

Docs  Support

Support